The Decentralized Guardians

The Role and Economics of Validators in Securing Solana Network's Future Sustainability

Table of Contents:

Let’s Explore the Guardians(a.ka. Validators) on Solana

Diving into Fees and Economics on Solana Vs Major Blockchains

Solana Innovations in Fee Structures

Tackling Spam Reduction on Solana

Solana’s Challenges: The Seeds of Innovation

Solana’s Sustainability and Future Outlook

Technological Advancements and Developments

Upcoming Developments

Potential Future Implementations for Validator Economics

Let’s Explore the Guardians(a.ka. Validators) on Solana

Imagine a world of instant financial transactions, secure data storage, and powerful decentralized applications, all running on a lightning-fast blockchain. That’s the reality of Solana, a revolutionary network revolutionizing the way we interact with the digital world.

But who are the silent guardians of this world, ensuring its security and smooth operation? Meet the Validators, the backbone of Solana, and explore the intricate world of Solana Validators and Fee Economics.

Into the heart of Solana’s ecosystem, exploring the vital role of validators and the intricate dynamics of fee economics. We’ll explore the contributions of Solana’s dedicated validators, who play a crucial part in the network’s sustainability and growth.

Simplified Proof-of-History (PoH) Algorithm

For starters, “Imagine the Solana network throws a party. Validators are the ones making sure the venue is secure, the music’s pumping, and there’s enough cake for everyone (keeping the network running for all users”-0xmarkdams

Moreover, Validators are the lifeblood of the Solana network. Running specialized software, they diligently process transactions, validate blocks, and uphold the integrity of the blockchain. As the guardians of Solana’s decentralized ledger, ensuring that everything functions smoothly and securely is paramount.

Diving into Fees and Economics on Solana Vs Major Blockchains

Compared to other major blockchains, Solana has relatively low transaction fees that are designed to scale with network usage. The current default fee is 0.000005 SOL (or 5000 Lamports) per transaction. Compared to the average fees across many major blockchains, Solana boasts significantly lower transaction costs that are designed to scale efficiently with network usage.

Solana’s impressive transaction processing speed, boasting potential for 50,000 to 70,000 transactions per second, keeps per-transaction costs for validators low. (Later, I will provide a comprehensive overview of Solana’s tech, explaining why it is significant.)

These low costs translate to minimal fees for users, making transactions on Solana a fraction of the cost compared to other blockchains. This creates a “win-win situation” — users benefit from a smooth and affordable experience, while validators are still compensated for securing the network.

Now let’s run into the details of how validators are compensated,

Validator’s Incentives

Validators on the Solana network benefit from a diverse range of incentives, including Maximal Extractable Value (MEV), Commission, Block rewards, etc., encouraging them to participate actively in securing the network and maintaining its integrity.

Example formula (not exact) for Solana validators to calculate their profit:

Profit = (Block Rewards * Stake Percentage * (1 - Commission Rate)) + (MEV Rewards * Stake Percentage) - OperationalCostsWhere:

- Profit: Annual profit

- Block Rewards: The rewards validators receive for processing transactions, securing the Solana network, and being selected as the leader of a given block. Leaders receive additional rewards (i.e. Base fees and Priority fees, which I’ll discuss later in depth in the Fee Structure of Solana).

- Stake Percentage: The proportion of the validator’s total SOL stake (including self-stake and delegated stake) compared to the overall staked SOL on the network. A higher stake percentage means greater potential rewards.

- Commission Rate: The percentage of rewards the validator keeps as a fee for its services (e.g. annual inflation rate which is subject to change.

- MEV Rewards: Additional rewards earned by validators running specialized software like Jito-Solana to capture Maximum extractable value (which is Approximately 8% MEV commission). To learn more about JITO’s MEV.

- Operational Costs: Hardware costs + Bandwidth and Networking + Cloud or Data Center Hosting + Electricity and Cooling + Maintenance, Vote fees, and Support. To know Solana Validator Requirements.

“MEV is a rapidly growing business model for blockchains. JITO has a great approach to maximize the benefits of MEV to the network and minimize the negative externalities of MEV to the rest of the users and applications running on Solana.” -Anatoly Yakovenko

Commission

The commission is the percent of network rewards earned by validators that are deposited into the validator’s vote account. The remainder of the rewards are distributed to all of the stake accounts delegated to that vote account, proportional to the active stake weight of each stake account.

- Example: If a vote account has a commission of 10%, for all rewards earned by that validator in a given epoch, 10% of these rewards will be deposited into the vote account in the first block of the following epoch. The remaining 90% will be deposited into delegated stake accounts as immediately active stakes.

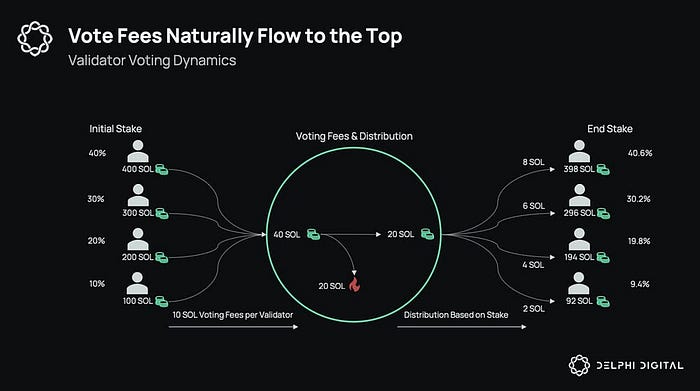

How do Voting Fees Affect Validator Economics?

Voting fees cover the necessary expenses for validator operation. Without them, validators might not have enough SOL to cover vote transaction costs, impacting their ability to participate in consensus.

As voting fees are deducted from rewards before the commission is applied, they affect the overall earning potential for a validator.

Consider this example:

- Initial Stake: 100 SOL (assuming 10% of the total stake)

- Voting Fee: 10 SOL (paid upfront by the validator)

- Reward Before Commission: 2 SOL represents 10% of the 20 (out of 40 SOL stakes due to the “burn mechanism” as seen in the diagram below, about 20 SOL)

End Stake: 92 SOL (considering the initial stake minus the voting fee)

This mechanism incentivizes validators to increase their stake and maintain high uptime, as higher stakes lead to higher voting fee rewards. It contributes to the economics and sustainability of validators by providing a revenue stream proportional to their stake and performance.

Delegators

As individuals or entities that are Solana token holders, you can delegate or “stake” your tokens to a validator. Instead of running a validator node( i.e. servers, computers) yourself — which then you can earn rewards by staking $SOL token to the validators. Moreover, as token holders, you will be eligible to vote. Your voting power is proportional to your stake — more $SOL staked equals more weight in your vote.

I highly recommend the Cogent Validator Profit Calculator to you to understand more about validator profitability.

Comparative Analysis Between Solana and Other Major Blockchains

Solana Innovations in Fee Structures

Solana has introduced some novel approaches to fee structures that aim to enhance the network’s scalability, security, and usability which drive growth for the network.

Here are a few key innovations in Solana’s fee structures:

Solana ultra-low Base Fees (as mentioned above around 0.000005 SOL or 5000 Lamports) making it cheap and more User friendly: This fosters high transaction volume and network growth. Users benefit from these affordable fees, especially in DeFi applications where frequent low-cost transactions are essential for activities like trading, lending, and borrowing crypto assets.

Solana offers an optional mechanism called Priority Fees which, alongside Stake-weighted Quality of Service (SWQoS), introduces a multi-layered approach to transaction scheduling with market-driven elements. By offering higher fees, users can influence the order in which their transactions are processed (Think of it as a Fast Lane). This can be particularly relevant during periods of high congestion caused by various factors, including bots that exploit MEV opportunities (later we will explore solutions of Solana Validator clients and how they optimized network efficiency and mitigate the potential negative impacts of MEV).

Moreover, SWQoS ensures a foundation of fair network access for validators based on their stake, preventing spam and Sybil attacks. It guarantees validators a minimum percentage of transactions they can submit to the leader node, regardless of congestion. Priority Fees then provide users with an additional layer of control. They can attach extra fees to incentivize validators to prioritize their transactions even within a busy network, offering a way to “jump the queue” alongside the baseline provided by SWQoS.

To prevent blockchain bloat, streamline validator workload, and incentivize network security, Solana employs a rent mechanism. Accounts must maintain a minimum balance proportional to the data they store. This encourages efficient space usage, allows accounts with long-term utility to become rent-exempt, and rewards validators with a portion of collected rent fees.

Fee Burning:

A portion of the transaction fees on Solana are permanently removed from circulation (burned). This is a deflationary mechanism aimed at controlling the long-term supply of SOL and “potentially” increasing its value.

Local Fee Market:

Unlike traditional blockchains with a single fee for all transactions, Solana uses a system where fees are determined by the demand for specific smart contracts or programs. Think of it like paying different tolls on different highways depending on traffic congestion.

Ultimately, Solana’s fee model aims for predictability. This translates to transparent costs and the ability to calculate transaction costs in advance, making Solana attractive for developers and projects that need to manage operational finances reliably. Moreover, these innovations further optimize the balance between validator incentives, user experience, and network sustainability.

“As a Stakers, Solana’s fee structure makes sense. It rewards active participation and keeps the network running smoothly. Great balance of incentives.”-0xmarkdams

Tackling Spam Reduction on Solana

Like any high-performance network, Solana faces the challenge of spam transactions or network congestion (which can be caused by legitimate transaction volume, but also by the activity of MEV bots). Due to its popularity, malicious actors can target Solana with meaningless transactions essentially flooding the network with junk to trigger denial-of-service (DoS) attacks or inflate fees.

To combat this, Solana utilizes various validator clients, like Jito Labs, and Solana Labs Client which employ techniques like fee prioritization and stake-weighted quality of service (QoS) to prioritize legitimate transactions, continue below to have more detailed information on how Solana tackles Spam with specific client approach and General mitigation and meet the validator client on Solana.

Client-Specific Approaches

- Bundle Mechanism: Jito offers a Flashbots-like bundle mechanism where transactions are grouped and bid on for priority inclusion. This can help filter out random spam.

- Multi-threaded Execution: Their client (software) can process bundles of transactions more efficiently, improving throughput under load.

- Block Space Auctioning: Jito facilitates an auction platform for allocating block space. This discourages MEV bots from spamming low-value transactions as they compete with other bots and users for priority inclusion in blocks. By placing bids, MEV bots reveal the value they see in a particular transaction, leading to a more efficient allocation of block space.

The funnel shows a high initial filter rate (over 96% of bundles are eliminated between “Sent to Bundle Auction” and “Forwarded to Validator”). This demonstrates the auction and bundle system’s success in deterring spam.

Solana Labs & The new forked Agave client by Anza

Clients (software) like Agave & Solana Labs worked together on making their validator software as efficient as possible, potentially squeezing out an additional performance boost within the constraints of the network rules (e.g. rigor patch testing and fine-tuned algorithms).

General mitigations include:

- Network Monitoring. Validators can actively monitor network activity for suspicious patterns that might indicate spam transactions.

- Stake Weight. Validator's stake sizes in $SOL tokens contribute to the network’s overall security. A larger stake discourages attacks as the potential slashing penalty becomes more significant.

- Local Fee Market. By isolating fee fluctuations to specific smart contracts, Solana prevents network-wide fee spikes that can occur on other blockchains during moments of overall high usage.

- QUIC. Solana leverages QUIC (Quick UDP Internet Connections) built on top of UDP (User Datagram Protocol). QUIC provides faster data transfer and congestion control compared to TCP (Transmission Control Protocol), making the network less susceptible to flooding attacks. Check Solana’s network status.

- In Solana’s Proof of History (PoH) algorithm, validators continuously generate hashes based on the previous hash and a timestamp. These hashes incorporate the previous hash and a timestamp, creating a verifiable record of elapsed time. This linked chain of timestamps prevents transaction replay and ensures a tamper-proof sequence of events, making it extremely difficult for anyone to spam the network. Any attempt to alter past information would be immediately detectable due to the broken chain of verifiable timestamps.

- Community collaboration. With over 1,600 validators from diverse geographical locations — Collaboration among validators strengthens the resilience of Solana against spam attacks and develops effective anti-spam strategies.

The community's commitment to reducing/coping with spam, not only benefits their operations but also contributes to the overall health and sustainability of the Solana ecosystem.

For starters, a Validator is like the ‘person or institutions’ and the Validator client is the Software they use to do their job. -0xmarkdams

Solana’s Challenges: The Seeds of Innovation

No blockchain network is born perfect, and Solana is no exception. The challenges it confronts present unique opportunities for growth and innovation that can shape the future of the Crypto industry.

Challenges as Catalysts. Like any groundbreaking technology, Solana’s trajectory involves overcoming hurdles. Ethereum, Bitcoin, and others have all navigated similar obstacles related to scalability, stability, and evolving economic models. Solana’s challenges push developers and the broader crypto community to find creative solutions.

Let’s explore these challenges and explore the areas where innovation shines through:

Challenges

- Hardware Requirements. Solana’s high-throughput nature necessitates powerful hardware for validators. This can create a barrier to entry and impact decentralization, potentially favoring larger entities.

- Validator Economics. Ensuring sustainable revenue streams for validators is crucial. Rewards from staking and transaction fees need to adequately cover their operational costs. Balancing these economic aspects is key.

- Network Congestion and Latency. During peak usage periods, Solana can experience congestion and increased transaction latency. Maintaining consistent performance even under load is essential.

- Centralization Concerns: Some critics argue that high validator requirements might lead to centralization over time.

Innovations and Solutions from Various Validator Clients

1. Jito-Solana

- MEV Solutions. Jito’s focus on Maximal Extractable Value (MEV) provides an alternative revenue stream for validators. By optimizing transaction ordering and bundling, they aim to increase revenue potential.

- Network Efficiency. Jito-Solana’s modifications aim to reduce spam and unnecessary transactions, improving network performance and potentially lowering overall fees for users.

- Block Engine. Jito’s Block Engine acts as an auction platform. MEV searchers bid on these transaction bundles, and the Jito client selects the most valuable combination for validators to process. This incentivizes MEV capture while filtering out less valuable transactions.

2. Firedancer

- Performance Breakthroughs. Firedancer’s C++ implementation strives for massively increased throughput and decreased latency. This could lead to reduced congestion and a smoother, cheaper experience for network users.

- Hardware Accessibility. If Firedancer achieves its goals, increased efficiency could potentially lower the threshold for hardware requirements. This may open the door for a wider range of validators.

- Fee Market Development. The Solana Foundation is actively researching and experimenting with dynamic fee structures (e.g. Time-Based Fees, Transaction Type Fees) and priority fee mechanisms (e.g. User-Determined Priority Fees, Auction-Based Priority, Hybrid model) to establish a more predictable and user-friendly fee experience.

- Staking Innovations. Exploration of potential improvements to the staking process to create a more attractive landscape for smaller and independent validators (i.e. creating user-friendly staking tools and educational resources to encourage SOL holders to stake their tokens).

- Grants and Ecosystem Support. The Foundation plays a key role in fostering innovation by funding development projects addressing validator economics, fee structures, and decentralization issues.

- Attracting Talent and Resources. Ambitious goals attract brilliant minds (through hackathons & others alike) and investment. The focus on improving Solana fosters a vibrant development ecosystem, ultimately benefiting the entire Web3 landscape.

It’s important to view Solana’s challenges not as roadblocks, but as springboards for improvement. Overcoming them will solidify Solana’s position as a major player in the decentralized future and create valuable advancements in blockchain technology as a whole.

Solana’s Sustainability and Future Outlook

As blockchain technology continues to gain mainstream adoption, concerns about its environmental impact have become increasingly prevalent. Among these concerns, the energy consumption of Proof-of-Work (PoW) systems like Bitcoin has drawn significant criticism. Solana, with its innovative Proof-of-Stake (PoS) consensus mechanism and energy-efficient design, stands as a beacon of sustainability within the cryptocurrency landscape.

Since the first energy use report in November 2021, the Solana Foundation has pledged to regularly measure and publish the carbon footprint of the network and make the network carbon neutral via offsets.

Solana claims to be more energy efficient than other blockchains like Ethereum. The transparency of these metrics allows for informed decision-making and proactive measures to enhance sustainability as the network evolves and adoption grows.

“By publishing details on their energy usage and associated carbon emissions, Solana is being transparent about the environmental impact of their blockchain network. This shows they are taking responsibility and not hiding anything.”-0xmarkdams

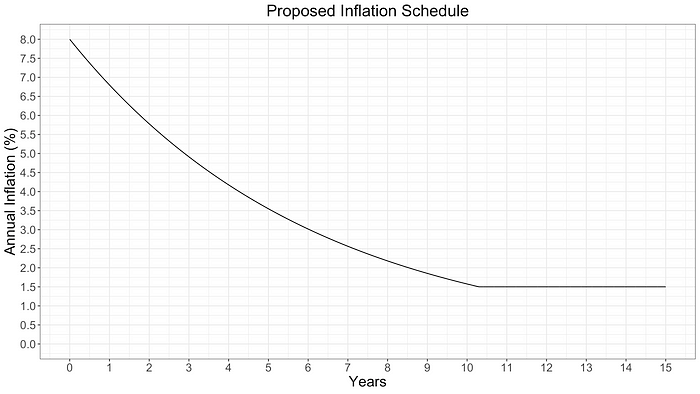

Proposed Inflation Schedule

Solana’s Proposed Inflation Schedule outlines a gradual decline in block rewards over time. This planned deflation exerts downward pressure on the supply of $Sol, “potentially” making it more appealing as a store of value. Additionally, as Solana matures, its reward structure shifts towards a more sustainable model. While block rewards gradually decrease, transaction fees gain importance, incentivizing validators to prioritize network efficiency and process transactions reliably.

At first glance, deflationary models might seem to jeopardize validator income. However, several factors mitigate this concern:

- Holding Rewards. If validators choose to hold their accumulated Sol rewards, the potential appreciation of Sol due to deflation could offset the decrease in block rewards, leading to sustainable income in the long term.

- Increasing Transaction Fees. As Solana’s adoption grows, so will the volume of transactions. Consequently, validators stand to derive a significant portion of their income from transaction fees. This shift towards a fee-based model ensures continued compensation for validators as block rewards taper off.

It is important to note that the long-term impact on the price of Sol depends on various factors like adoption, utility, and overall cryptocurrency market trends. Deflationary pressure could make Solana ($Sol) more attractive as a store of value and potentially drive up its price in the long run.

Nakamoto Coefficient

A higher Nakamoto Coefficient demonstrates a robust and decentralized system better equipped to face potential attacks, inspire user confidence, and remain sustainable in the evolving world of blockchain technology.

Network Activity

The daily number of transactions, total fees, and total additional fees on Solana are critical metrics for validator economic sustainability. A healthy, active network with balanced fee structures is essential for long-term validator viability and a secure Solana ecosystem.

Low transaction fees create a more user-friendly and accessible blockchain experience. This fosters broader adoption, innovation, and the overall growth of the network.

“Seriously all of CT that heard of JITO will start farming Solana, instantly recognizing how frictionless the user experience is, and have an insanely hard time returning to wherever they came from. This IS Solana’s cycle.”-THGsol

Technological Advancements and Developments

Solana’s development roadmap is brimming with exciting advancements and innovations designed to propel the network to the forefront of blockchain solutions.

Important key components:

Scaling and Performance

- Turbine. enhances block propagation for lightning-fast transaction speeds.

- Solana Virtual Machine (SVM). which is built upon Sealevel enables unparalleled parallel processing, dramatically increasing throughput.

- Gulf Stream. in Solana facilitates transaction forwarding without relying on a mempool (a temporary queue for pending transactions). This streamlines the validation process and improves efficiency. Moreover, by increasing transaction throughput, it indirectly discourages spammers.

- Pipelining. optimizes the Transaction Processing Unit, ensuring efficient validation.

Robust Infrastructure

- Cloudbreak. introduces a horizontally-scaled Accounts Database, providing exceptional data management capabilities.

- Archivers. offer a distributed ledger store for long-term data security and accessibility.

Security and Cross-Chain Capabilities

- Tower BFT. a PoH-optimized PBFT (Practical Byzantine Fault Tolerance) implementation, augments network resilience and security.

- Expanded cross-chain functionality enhances interoperability with other blockchain ecosystems.

These advancements position Solana as a leading blockchain solution, offering robust scalability, unparalleled performance, and a commitment to long-term security and interoperability.

Upcoming Developments

- Firedancer. is a new third-party validator client (software that holds and uses private keys to make attestations about the state of the blockchain), developed by Jumpcrypto for the Solana blockchain that aims to improve the network’s efficiency and transaction processing capabilities.

The core aims of Firedancer are to:

- Boost Throughput. Significantly increase transaction processing capacity. Firedancer aims to boost Solana’s transaction throughput to over 1 million transactions per second (TPS). disclaimer — achieving consistent 1 million TPS in daily use might require further optimization.

- Enhance Reliability. Improve network stability and reduce potential downtime.

- Client Diversity. Break Solana’s reliance on a single validator implementation, improving overall network resilience.

- Reduced Bottlenecks. If Firedancer is successful in increasing throughput, it could alleviate network congestion and lower transaction fees during periods of high demand.

- Leader Scheduling. Firedancer will implement leader scheduling, allowing multiple validators to propose blocks simultaneously, improving network throughput, and potentially reducing the impact of a single leader prioritizing high-fee transactions.

“Just listening to the Firedancer talk at Breakpoint blew me away. Whoever claims that Solana’s performance is just about higher hw requirements doesn’t do those geniuses justice.”-@Wealthineer1

Potential Future Implementations for Validator Economics

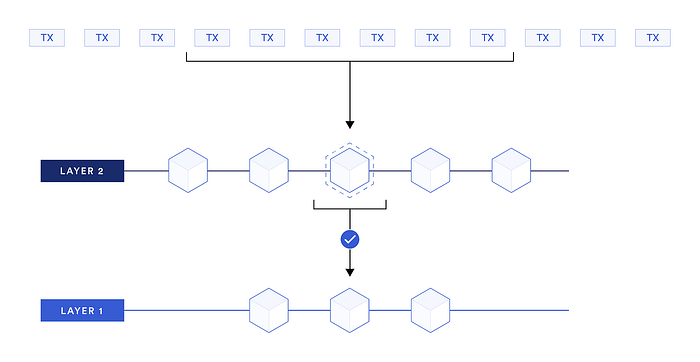

Zero-Knowledge (ZK) and L2 Solutions

- ZK Rollups. ZK Rollups bundle multiple transactions off-chain and generate a succinct proof of validity that is then recorded on-chain. This drastically reduces data requirements and thereby transaction costs.

- Privacy Features. ZK technology also facilitates the potential for fee obfuscation, allowing users to submit transactions without publicly disclosing the value, enhancing privacy.

- Layer-2 Solutions. Integrating with layer-2 scaling solutions could generate additional fees for validators processing transactions off the main chain these can potentially support validators under low inflation.

3. Explore Delegated Proof-of-Stake (DPoS) Variations; exploring variations of DPoS could allow for a more flexible fee distribution system that incentivizes validators these models can potentially support validators under low inflation.

4. Micropayments for Specific Services under low inflation:

- Data Storage. Validators could charge fees for storing data on the blockchain (like NFTs, or other long-term records). This creates a new revenue stream tied to specific network use.

- Oracle Services. Validators who act as reliable data oracles (feeding real-world information into the blockchain) could charge fees per query or on a subscription basis.

- Specialized Computation. Validators with powerful hardware could offer computation services for complex dApps, charging fees based on the resources used.

5. Ecosystem Development Grants

- Solana Foundation Support. The Solana Foundation could allocate grants or subsidies to incentivize validator participation, especially during the transition to lower inflation.

- Developer Bounties. Projects building on Solana could offer rewards or bounties to validators who help maintain network stability and security.

- DAO-Governed Incentives. Consider a DAO (Decentralized Autonomous Organization) to manage a portion of staking rewards, allowing community-driven flexibility and targeted incentives based on evolving network needs.

Stay tuned! for the latest developments in the world of Solana, and don’t hesitate to engage with validators to gain deeper insights into the inner workings of this remarkable blockchain. Together, we can shape the future of decentralized finance and contribute to the creation of a more secure, transparent, and sustainable digital economy.

Caveat! “The article emphasizes that it does not contain sponsored content or financial advice. Instead, it offers educational insights into cryptocurrency within the Solana ecosystem. Readers are urged to research independently and consult financial professionals before investing. The article underscores the volatility of the cryptocurrency market and advises caution in financial decisions and The opinions reflected herein are subject to change without being updated.”

References:

- https://solana.com/validators

- https://solana.com/docs/intro/transaction_fees

- https://medium.com/solana-labs/solanas-network-architecture-8e913e1d5a40

- https://solana.com/staking

- https://beta-analysis.solscan.io/public/dashboard/06d689e1-dcd7-4175-a16a-efc074ad5ce2

- https://docs.solana.com/introduced-concepts/rent

- https://solanaclimate.com/

- Other sources consulted are duly hyperlinked.

Feel free to reach out to me on Twitter @Oxmarkdams or @realmarkdamascowith any suggestions or opinions. If you find this even slightly insightful, please share it — I’ve invested countless hours crafting this content, and your support means everything in helping it reach a wider audience. Thank you.